by Frank Stricker

November 15, 2023

In the Bureau of Labor Statistics’ (BLS) Employment Situation for October, the official unemployment rate rose by a tenth of a percentage point to 3.9%. Many subcategories also increased by a tenth. One exception was that the unemployment rate for black teens fell from 24% to18.8%, a significant drop. But that is a category that tends to show extreme changes from month to month. And in any case, 18.8% is nothing to be happy about.

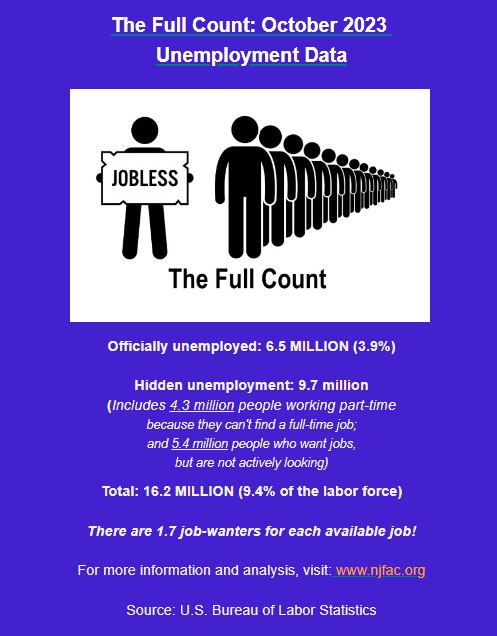

The official unemployment rate has been inching up for several months. Also, the National Jobs for All Network’s (NJFAN) real unemployment rate or Full Count—that includes more workers who need jobs than are counted in the official rate–rose by .2 to 9.4%. We are far from real full employment.

But we are not in a recession. Mainstream commentators—Kelly Evans at CNBC is an example–have been trying for months to prove that we are in the early stages of one. It is possible that the full effects of the Federal Reserve’s interest rate hikes are still to be felt. But the U.S. economy grew at the high rate of 4.9% in the third quarter (July-September). That is real growth, not the effect of inflation lifting the price of everything. Another positive is that the number of people making initial claims for unemployment benefits fell in the last two months. In prior months, the average number was as high as 256,000, but in the last 8 weeks the averages have been as low as 206,000.

A third plus is that inflation-rate increases have come down. The total increase in October was zero. Still, the total annual increase was just 3.2%. But there is always a danger that Jerome Powell, Chair of the Federal Reserve, will be freaked out by a bump in prices or judge that demand for workers is too high. But according to some numbers demand for workers is weakening and this bolsters the prophets of doom. As mentioned, the unemployment rate has crept up for several months. Also, in the survey of employers, which covers non-farm employees (no gig workers), jobs increased only by 150,000, a pretty low number. And in the household survey, which is a smaller sample and said not to be reliable in some areas, the total number of employed Americans fell by 348,000. What’s going on? Some of the unemployed are workers on strike—96,000 in October. But the rest? The latest JOLT report does not cover October, but the previous months showed no significant increases in worker quits and layoffs and no decreases in hiring, as we might expect in a worsening labor market. [1]

By the way, many workers being out of work to fight for a better deal is a good kind of unemployment. Auto workers won substantial improvements. Some jobs are being upgraded, and the impact will be large. A Ms. Tenisha Hodge had been working full time as a temp at Chrysler earning just $16 an hour. She had to take second jobs to pay the bills. Under the new contract, she will become a permanent worker, and her pay could more than double to $40 an hour in three years. [2]

Wages and Inflation

Average wages have begun to advance faster than inflation. Real (purchasing power) hourly pay for rank-and-file workers was up in October by 1.4% over a year earlier. Not much, but in October of 2022, real wages were down 2.1% from a year earlier. So that’s a good change.

Although the rate of inflation increases has fallen, most prices are not going to fall back to where they were before the pandemic, however much we wish it. (The fact that most prices keep rising, although often slowly, can be a problem for President Biden, who takes credit for lower inflation. He cannot get prices back to pre-pandemic levels and I have not heard him say that he never promised no inflation.)

Meanwhile, prices and payment burdens have become more onerous. The Fed’s high interest rates make the cost of buying a home prohibitive for many would-be buyers. Yes, the Fed caused inflation in this area. In other areas, too, people can’t afford things. The student loan-relief program is ending. Child-care costs are up 30% since 2019. And millions of jobs are really lousy. There are 19 million workers who earn less than $15 an hour. [3] For them, getting a living wage would make a bigger difference than a 1- or 2-point decrease in the rate of inflation.

Frank Stricker writes for the National Jobs for All Network (NJFAN) and for Dollars and Sense. He is a retiree-member of the California Faculty Association, the union for professors in the California State University and College System. He wrote American Unemployment: Past, Present, and Future. His opinions are not necessarily those of any of his organizations.

[2] This story and many other useful facts and perspectives are in Talmon Joseph Smith, “Job Growth Slows, Sowing a Mix of Concern and Calm,” New York Times, November 3, 2023.

[3] Information provided to me by June Zaccone, NJFAN, and located at Low-Wage Workforce Tracker, Economic Policy Institute, April 2023, https://economic.github.io/low_wage_workforce