by Frank Stricker

September 8, 2023

The Numbers Tell an Ambiguous Story

The Bureau of Labor Statistics’ Employment Situation for August showed that unemployment rates were on the rise. The rate for Hispanics climbed from 4.4% to 4.9%, for whites from 3.1% to 3.4%, and for persons with disabilities from 6.9% to 7.4%. The Black rate was a surprising outlier, falling from 5.8% to 5.3%. The unemployment rate for the whole labor force increased from 3.5% to 3.8%, so it is rising but still under the 4% level that mainstream economists used to think was essentially full employment.

In the household survey from which we derive the figures just mentioned, the number of unemployed persons jumped by 514,000. That’s a lot, but the number of employed persons increased by 222,000. On the one hand this and on the other hand that. Why the surge of job-seekers–the unemployed–is not clear. Perhaps it is just a crazy one-month blip. Or perhaps more people had to look for work more diligently because they were running out of money. Some may have used up their cache of savings from pandemic benefit programs.

If unemployment is on the rise, are we entering a recession? It is hard to tell. In a separate publication, the Bureau of Labor Statistics showed that initial unemployment claims in recent months were roughly 20% higher than last fall. The number of people receiving benefits every week in regular state programs was about 25% above last year’s level. As far as unemployment benefits are concerned, we are on a higher plane than a year ago. But there has been no sustained increase in the number of beneficiaries recently, as we might expect if we were beginning a recession.

The unemployment rate and many job numbers come from the monthly survey of 60,000 households. But the most watched job total is from a survey of several hundred thousand non-farm employers. It’s called the payroll or establishment survey. Here jobs increased, in the initial count, by 187,000. Not too hot. Not too cold. Modest growth ought to keep officials at the Federal Reserve from biting their collective nails about excessive and inflationary job growth. But will it? By the way, the final revised payroll job addition totals for June and July were 105,000 and 157,000, not signs of a hot job market. If those two months are the model, then the final revised job increase for August will be less than 187,000.

These numbers and the current rise in the unemployment rate show that the Fed has no reason to raise interest rates in order to stymie wage and price growth. Job growth is okay but not booming. Employers have posted somewhat fewer vacancies, and worker quit-rates are down a bit, suggesting that workers are a little less confident about finding new jobs. Kelly Evans of CNBC often suggests that we are in or will soon be in a recession, but I hope that the economy is just in a slight chill. A lot depends on Fed Chair Jerome Powell who seems obsessed with getting inflation down to 2.0%. The inflation index he prefers is now running at 2.4%. We are pretty much where he wants us to be, but he does not see it that way. He wants a weaker job market.

We Need More Jobs, Better Jobs, and Easier Retirement

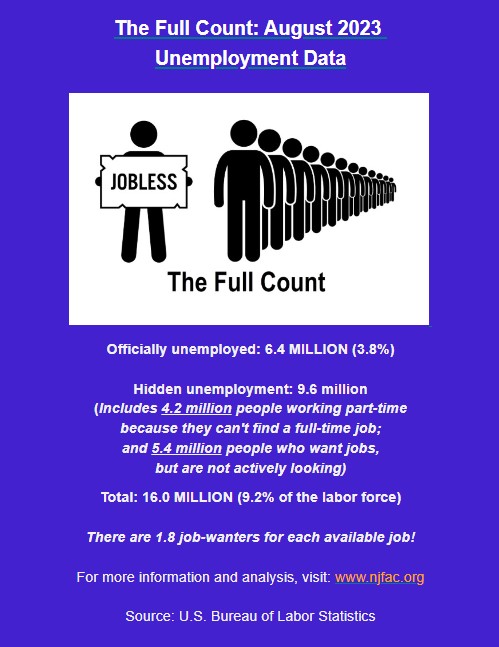

We at the National Jobs for All Network want real full employment. That means many more jobs, and many more good jobs. As you can see in our Full Count, we believe that the real unemployment rate in August was 8.7%, not 3.8%. There are 15 million people who are unemployed or underemployed at part-time jobs because they cannot get full-time work. Whether or not the official unemployment rate goes up or down a little may suggest job market trends, but it does not tell us how far away we are from real full employment.

Nor about job quality. People who work hard shouldn’t have to worry about whether they can pay the rent or buy enough food for their families. And they ought to be able to retire some day. And they ought to be treated respectfully on the job and have paid vacations. While the number of lucky people taking early retirement rose during the pandemic rose, many workers were and are too poor to retire.

But aren’t average wages pretty high? The average hourly wage for a production/non-supervisorial worker in the private sector is $29. That sounds pretty good. It’s $60,000 for a full year of work. But while that amount might be fine in eastern Kentucky, it’s not enough to pay the bills and accumulate savings in metropolitan areas, especially not in big ones like New York and Los Angeles. And there’s another disclaimer. That $29 is not the minimum wage. It’s an average. Millions of workers earn more and millions earn less, often much less.

And by the way, gig work is not the answer. Drive for Uber? A couple of years ago, Ken Jacobs and Michael Reich, two researchers at the University of California’s Labor Center in Berkeley, determined that after unpaid waiting time, deductions for full payment of Medicare and Social Security taxes, and the cost of upkeep on the vehicle, Uber drivers were averaging about $6 an hour.

In the years prior to the pandemic, increasing numbers of people over 55 were re-entering or staying in the labor force. One reason was that they could not afford to retire. Many had worked at lousy jobs and had low savings. And it is still that way, especially for some groups. Half of the households headed by older Blacks and Hispanics are “financially fragile”; they are all but drowning in debt, housing costs, and lack of savings. These are people too poor to retire.

Lousy jobs (and other reasons for higher poverty rates in these groups) have dire long-term consequences. More people will be working into their late 60s and 70s. Most of the people who won’t be able to retire are not professors orating in air-conditioned classrooms. Some have strenuous jobs working outside in very hot or very cold weather; or inside, cleaning 15 rooms a day in an up-scale hotel in Los Angeles; or lugging sick people around in a nursing home; or doing the dishes in the hot, crowded kitchen of an expensive restaurant. A couple of them mow my lawn every week, which isn’t wonderful, but better than farm work in 110-degree weather in California’s Coachella Valley.

Some useful non-governmental sources:

Teresa Ghilarducci and Christopher D. Cook, No Way Out: Older Workers Are Increasingly Trapped in Crummy Jobs and Unable to Retire. Posted on April 28, 2023, Working Economics Blog, Economic Policy Institute.

Michael Hiltzik, “Shoplifting? Employer Wage Theft Is a Bigger Deal.” Los Angeles Times, August 30, 2023.

Steve Lopez, “Retire? Senior Hotel Workers Can’t Afford To.” Los Angeles Times, July 16, 2023.

Robert Kuttner, “The Economy: Steady as She Goes,” September 1, 2023 “Today on TAP” (The American Prospect online).

Frank Stricker belongs to Democratic Socialists of America and is on the board of the National Jobs for All Network. He is a retiree-member of the California Faculty Association, the union for professors in the California State University and College System. He wrote American Unemployment: Past, Present, and Future. His opinions are not necessarily those of any of his organizations.