by Frank Stricker

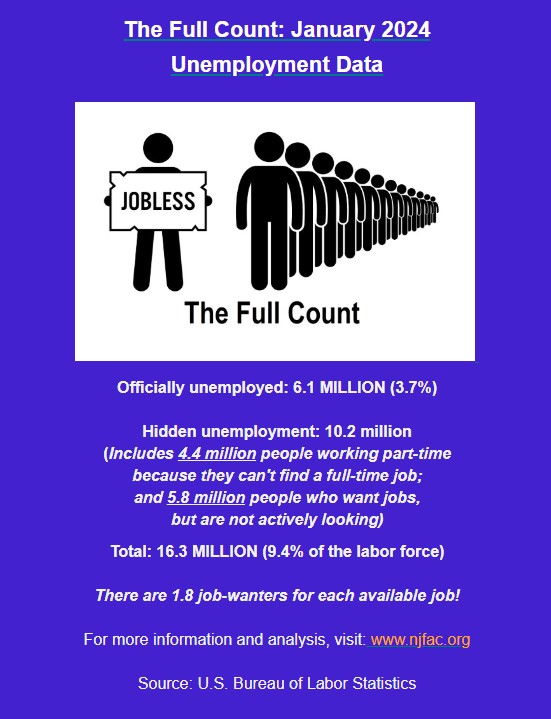

The Bureau of Labor Statistics’ report on jobs and unemployment for January was mostly positive. It continues a string of generally upbeat reports over the last two years. Official unemployment stayed under 4% for the 23rd month in a row. It was 3.7%. The Hispanic rate was still high at 5% and so was the black rate at 5.3%. But the latter may be a record low in modern times. The black teen rate was still very high at 11.6%. And the National Jobs for All Network’s real unemployment rate, including people who want jobs but haven’t searched recently and part-timers who want full-time work, was still extremely high at 9.4%.

Also worrisome to me is the fact that in the household survey from which we derive the total labor force and the unemployment rate, the number of employed persons fell by 751,000 in December and January. Seems like a shocker, but experts don’t pay much attention to that statistic. For job totals, they like the government survey of thousands of businesses, governments, and other non-farm establishments. Good news here: 330,000 jobs added in December and 353,000 in January.

So two big positives in the surveys. Lots of new jobs in one survey and an unemployment rate under 4% in the other. Many people still believe that 4% unemployment is full employment. It isn’t. And yet during the recent surge of consumer prices, some economists, including Larry Summers, thought we had to cause significantly more unemployment to get economic demand and prices down. That is, we needed a recession to tame raging inflation. Turns out we did not. Much of the inflationary surge was caused by supply-line issues and profit-grabs by big businesses. Some of these things solved themselves and some must have been moderated by Biden programs. So while there is still inflation, and many prices are not going down or not much, the rate of increase has definitely moderated. The Consumer Price Index for the year ending in June of 2022 increased 9.1%. The Index for the year ending in January of this year rose 3.1%. And we’ve done it without an anti-inflation recession. On the contrary, the economy has grown for several years and sometimes strongly. Our annual output, which was once equal to the total output of all the countries in the Euro zone, is now almost twice as large. Economic news seemed so good that conservative commentator and sometime Trump advisor Larry Kudlow admitted on Fox news that this was a very good economy. Kudos to Kudlow. I never thought I’d write that short sentence.

And the public is finally getting the message. For months there was a disconnect between low unemployment and other good news on the one hand and how people felt about the economy on the other. One explanation is that it takes people a while to catch up with reality. But I think we should also remember the heavy burdens that weigh upon millions of households even when general trends are positive. First, there is a point I’ve already mentioned. Price increases are abating but some prices aren’t falling or not much. I do a lot of grocery shopping and I am still shocked at how expensive some things are.

Second, official unemployment is quite low but real unemployment is high—almost 10%. Real unemployment, we at NJFAN estimate, may directly affect 16 million people and their families at any time. A third factor fueling pessimism is that millions of people are poor or nearly poor. Some have trouble making the rent every month. Some are running up huge amounts of debt on their credit cards and paying horrendous interest charges.

Fourth, average real wages, measured in terms of purchasing power, are up, but not much. Just a 1.4% increase for private sector non-farm workers over the last year. And for many workers wage levels are really lousy. Average non-farm private sector workers earn $30 an hour but many earn much less than the general average. People in the retail sector average only $20.73 an hour. And even $30 an hour is not that much.

Average weekly hours in the non-farm, non-government group are 34.1. If an employee works 50 weeks of 34 hours over the year, that is 1700 hours a year. Times $30 equals $51,000 a year. And less after deductions. The total might be fine for a single person, but for an adult with even one child in a big city, it won’t go very far. And yet $51,000 is 2½ times the government poverty line for such a two-member family. That shows you how antiquated and ridiculous our poverty lines are.*

* In 2022, according to the U.S. Census Bureau, median annual earnings for all workers were $47,960. Thus, $51,000 is close to the median. On another topic, in the September 2023 government poverty report for 2022, the poverty line for an adult and one child under 18 was $20,172. Over that and you were not officially poor. I kid you not.

Frank Stricker is on the board of NJFAN and is still Emeritus Professor of History and Labor Studies at California State University, Dominguez Hills. He is the author of American Unemployment: Past, Present, and Future.